Blockchain Applications for Corporate PPAs

Blockchain presents a highly secure system for the execution of transactions and the recording of information. There are some strong use cases for blockchain in the energy sector; many of these relating to PPAs. Smart contracts – blockchain linked programmes intended to automatically execute, control, or document actions according to the terms of a contract – are highly suited to PPAs, which are simple bilateral agreements with readily available data on the exchanged assets: electricity and money.

One GMI study has cited that the global blockchain in power market was valued at USD 2.1 billion in 2024 and is estimated to grow at a compound annual growth rate of 41.5% from 2025 to 2034. Whilst some blockchain optimists have predicted that the application of blockchain technology to PPAs will remove the need for utility companies and create a peer-to-peer energy trading revolution, there are a number of regulatory considerations to be kept in mind.

Real-time settlement

Offtakers under a pay as produced PPA could have their meters linked to a smart contract which would allow for real-time settlement on a shared platform. Energy consumption under the PPA would be recorded and the generator could be compensated at intervals decided by the parties. This would benefit the generator as they could receive increased liquidity through weekly, daily, or even hourly payments, whilst offtakers could benefit from lower energy prices in return for providing this liquidity.

This real-time settlement capability is particularly valuable in the context of AI-driven energy demand, where consumption patterns can be highly variable and unpredictable. The ability to settle payments in near real-time provides generators with improved cash flow and offtakers with more responsive pricing mechanisms.

REGOs

The traceable, transparent and secure nature of the blockchain also makes it an ideal technology for the issuing and trading of renewable energy guarantees of origin (“REGOs”) which are often a crucial aspect of PPAs for the offtaker. REGOs allow businesses to prove that their energy is sourced from renewable generators which thus meeting their carbon reduction and sustainability reporting requirements. Blockchain allows verification of REGOs as their movement across transactions can be traced back to a specific supply of renewable electricity. This increases REGO security and trust by preventing fraud. This technology is already seeing use in PPAs with Sofidel and Acciona Energia announcing a blockchain integrated PPA in 2023.

Traceability is also particularly important due to the rise of cyberattacks and energy theft. One Stay Energy Safe study reported that there were 13,415 incidences of energy theft in the year 2024/2025 in the UK and energy theft costs UK consumers up to £1.4 billion every year.

Peer-to-peer energy trading and blockchain PPAs

The delta between the energy produced by generators and that consumed by customers can result in inefficiency in the traditional PPA market. As the selection of generators and consumers becomes decentralised, blockchain can facilitate increased efficiency in the renewable energy market by matching production and consumption via PPA aggregation and peer-to-peer trading. PPA aggregation involves several offtakers pooling together to enter into a PPA with a generator (or number of generators via a virtual power plant) and smart contracts are an ideal way to execute agreements to determine who receives how much electricity and at which times. A PwC study also suggests that blockchain could lower transaction fees in energy trading by 30% - 50%. Peer-to-peer trading sits alongside a PPA but utilises the contractual agreement of a PPA to distribute offtake energy to a third party. The data on these transactions can then be stored centrally on the blockchain for access by all parties.

Case studies and real-world applications are on the rise. In September 2024, Karnataka in India implemented peer-to-peer solar energy trading using blockchain. Eligible participants must have rooftop solar projects with net or gross metering, and system capacities ranging from 1 kW to 2 MW.

Regulatory Considerations and Market Maturity

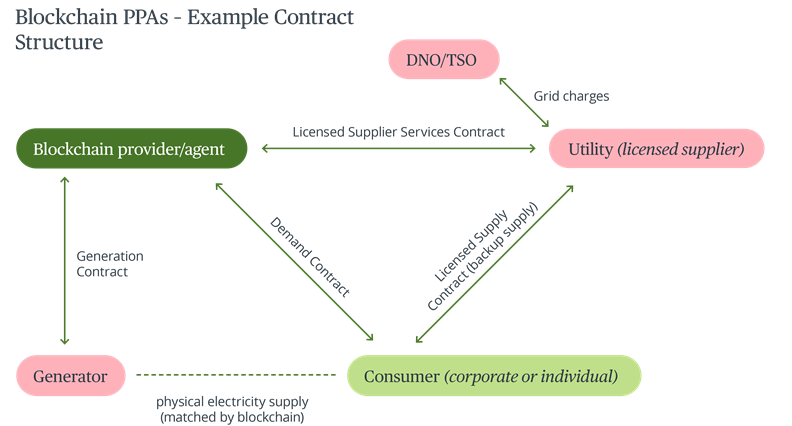

Whilst great for increasing efficiency in the energy system, peer-to-peer trading, in particular, raises regulatory concerns in terms of how electricity being supplied by one consumer to another would be licenced which is limiting its utility in many jurisdictions. Aggregation can also carry regulatory issues. Even with blockchain, the licensable activities within the electricity market still exist in the form of generation, distribution and supply. Whilst blockchain PPAs can match renewable generation and demand, this is only done virtually, there is still a physical regulated supply between generator and consumer. Parties therefore need to be clear which party is responsible for performing each of these regulated functions and paying necessary grid charges to transport the power. As both generator and corporate contract with the blockchain provider (rather than with each other), the generator may not know who the corporate is when it enters the contract, and there may not be any guarantee or security provided by the blockchain provider for the corporate’s obligations.

The relatively new nature of the technology, alongside these regulatory concerns, means that we are generally only seeing blockchain PPAs on a very short-term basis (around a year), but this could change as the market matures and regulatory concerns are explored and addressed.

The European Blockchain Regulatory Sandbox (launched in 2023 by the European Commission and open to all sectors) is facilitated by Bird & Bird, along with its consulting arm OXYGY. The Blockchain Sandbox provides a structured environment where public and private innovators exploring or implementing distributed ledger technologies such as blockchain can engage in regulatory dialogues with national and EU regulators. They can to discuss regulatory concerns and develop legally and commercially viable projects. A third tranche of 20 projects is due to be put through the Blockchain Sandbox in 2025, offering participants legal advice and regulatory guidance in a confidential setting. Bird & Bird is responsible for setting up a safe interface between developers and regulators, providing such legal and regulatory guidance. Blockchain-enabled PPAs have already been part of the Blockchain Sandbox and so initiatives like the Blockchain Sandbox will be vital for the maturation of blockchain-enabled PPAs.

Blockchain therefore presents a number of innovative solutions for the energy sector, particularly with regard to PPAs but also presents some regulatory hurdles.

If you would like to find out more, please visit our Corporate PPA Hub or get in contact with us.