What the Q&A; Commission’s recent FAQs sheds light on the CSRD

On 7 August 2024, the European Commission released a draft set of frequently asked questions (FAQs) on the EU's ‘Corporate Sustainability Reporting Directive 2022/2464’ (CSRD). The FAQs are designed to assist companies and other stakeholders, including auditors, in implementing the sustainability reporting requirements. They contain a more detailed explanation of the new EU rules on corporate sustainability reporting as the first reports under the respective national transposition of this Directive are due to be published early 2025 by companies listed in the EU, over the financial year 2024.

In contrast to the earlier ‘Non-Financial Reporting Directive 2014/95’ (NFRD), the CSRD introduces more comprehensive reporting requirements on the environment, human rights, social standards, and sustainability-related risks affecting both, which must meet the general ‘European Sustainability Reporting Standards’ (ESRS): (i) the company and (ii) the company’s own impact on society and the planet (and jointly known as ‘double materiality’). For more information regarding the CSRD, see our posts of 30 December 2022 and 31 January 2023.

Aim of the FAQs

The new FAQs incorporate questions and feedback received by the Commission from stakeholders and aim to reduce the administrative burden by offering greater clarity and certainty. The objective is to "facilitate stakeholder compliance with regulatory requirements in a cost-effective manner", and to ensure the usability and comparability of the reported sustainability information. In addition, it addresses key topics such as the scope of the rules, how to determine company size categories for compliance dates, available exemptions, which sets of ESRS to apply, and considerations for using estimates when value chain information is unavailable. It also outlines the sustainability information that SMEs should anticipate receiving due to the CSRD. Additionally, the FAQ covers auditing and assurance-related issues, including approval and training requirements for auditors and accreditation standards for independent assurance providers.

The key takeaways from the new FAQs relate to sustainability reports and sustainability statements, the application to large undertakings and large groups, and reporting exemptions, as will be discussed below.

Understanding the scope of Articles 19a and 29a CSRD

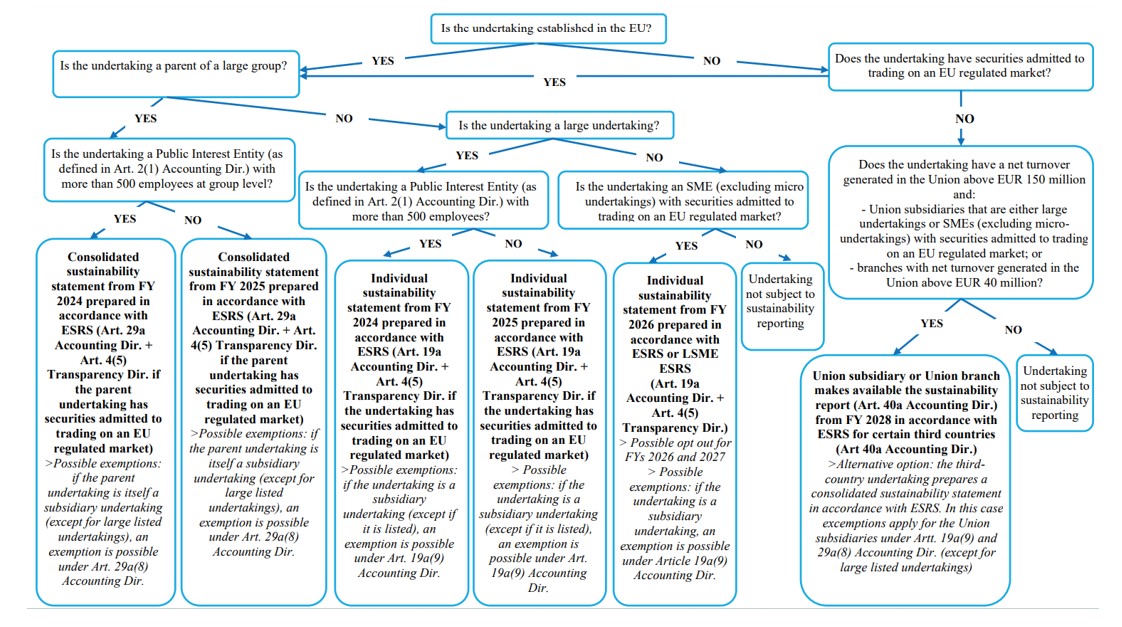

Articles 19a and 29a CSRD both deal with the applicability of sustainability reporting obligations, but they apply to different types of companies and have different scopes, which is depicted in the FAQs’ application flowchart:

Whereas Article 19a applies to individual ‘large undertakings’ as defined in Article 3(4) of the ‘(consolidated) Accounting Directive 2013/34’ (AAD)) – and to Small/Medium-Sized undertakings (also referred to as SMEs), with transferable securities admitted to trading on an EU regulated market as defined in Article 3(2)(3) AAD –, Article 29a applies to parent companies of ‘large groups’ as defined in Article 3(7) AAD. Both large undertakings and large groups can be part of larger (global) company organisations. The former includes entities with securities admitted to trading on an EU-regulated market, as well as large private companies that meet the CSRD’s thresholds. For large groups, the same thresholds apply but on a consolidated basis for EU-based parent companies and their subsidiaries. In that regard, the FAQs explain that Article 29a CSRD brings parent companies of large groups within the scope of the CSRD, even if these parent companies themselves are subsidiaries or sub-holding companies in larger groups ultimately owned by non-EU based parent companies.

The FAQs also clarify that while Article 29a CSRD requires the parent undertaking of a large group to publish a consolidated sustainability statement in its consolidated management report, this parent is exempted from the obligation to publish its individual sustainability statement if it also meets the criteria of a large undertaking of Article 19a CSRD.

Sustainability reports and statements

In addition, the Commission clarifies that there are differences between several sustainability statements required under Articles 19a and 29a CSRD and sustainability reports under Article 40a CSRD regarding large undertakings and SMEs with transferable securities admitted to trading on an EU regulated market.

A ‘sustainability statement’ refers to reports that need to be drawn up in accordance with the ESRS and published under Article 19a CSRD (individual sustainability statement) in case of large undertakings and Article 29a CSRD (consolidated sustainability statement) in case of large groups. This statement must reflect the entire value chain, including subsidiaries, to ensure transparency of sustainability practices. For the SMEs with transferable securities admitted to trading on an EU regulated market, the FAQs clarify that these may benefit from a designated (smaller) set of ESRS (based on Article 29c CSRD) and referred to as LSME ESRS (see our German post from 15 May 2024).

A ‘sustainability report’ under Article 40a CSRD can be more limited in its content compared to the sustainability statements in which more information is required such as details on opportunities, resilience, and risk. Such sustainability reports do not need to meet the ESRS but will have to comply with lighter reporting standards that will be developed by the Commission before July 2026. The primary intention of the sustainability report for 3rd country groups is to focus on their sustainability impacts, not so much on resilience, opportunities and risks.

Subsidiaries and reporting exemptions

Subsidiaries of large groups may be exempted from (individual) sustainability reporting obligations on the basis of Articles 19a(9) and 29a(8) CSRD. The FAQs clarify that if a subsidiary is included in the consolidated sustainability statement of its parent company, it may not have to publish its own individual sustainability statement. This exemption is conditional on the parent company’s report being accessible and comprehensive, including information about the subsidiary's exemption, as well as meeting the ESRS reporting standards. However, this is a limited exemption. Large undertakings with securities traded on an EU-regulated market, including small and non-complex institutions and certain insurance undertakings, must still comply with the reporting requirements, regardless of whether they are subsidiaries.

Reporting obligations subsidiaries of non-EEA (ultimate) parent companies

As preliminary remark, we note that currently the CSRD is not applicable to countries that are member of the ‘European Economic Area’ (EEA) – Norway, Iceland, and Liechtenstein – but we will We consider that implementation of CSRD into the EEA framework will happen in due time. Therefore, we refer to (non)EEA-based companies even though the CSRD strictly speaking does not yet apply in the EEA.

The CSRD also applies to EEA-based subsidiaries of non-EEA (ultimate) parent companies, either individually or as sub-group (on the basis of Articles 19a/29a CSRD) or as part of the global group’s reporting obligations under Article 40a CSRD.

Q48 of the FAQ clarifies that if a third-country (ultimate) parent company falls within the scope of Article 40a CSRD, there are two ways to fulfill its sustainability reporting obligations, each with different reporting requirements.

Non-EEA parent companies can choose to voluntarily prepare a consolidated sustainability statement for the entire group (including all its subsidiaries and branches) in accordance with the ESRS. This sustainability statement must include the undertaking’s impacts on sustainability matters, and concerning how sustainability matters affect the undertaking’s development, performance and position, pursuant to the ESRS. If global parent companies choose this route and meet all relevant conditions, all their EEA-based subsidiaries may be exempt from individual or sub-group reporting obligations, provided that they are not listed companies in the EU.

Alternatively, non-EEA parent companies may choose to publish a sustainability report under Article 40a CSRD in accordance with the lighter (yet to be defined) 3rd country standards. Under Article 40a CSRD, EU subsidiaries or branches are responsible for publishing a sustainability report at the group level on behalf of their non-EEA-based ultimate parent company. The parent company can prepare this report and is ultimately responsible, but it must be made accessible by the EU subsidiaries, either through an EU business register or online. It should be noted, however, that the EU subsidiary that publishes the group's sustainability report will not be exempt from complying with its own reporting requirements under Articles 19a and/or 29a if they meet these thresholds.

Reasonable effort

The concept of ‘’reasonable effort’’ is addressed in Q29 of the FAQ. This notion is used to determine when an undertaking can report an estimate of value chain information rather than precise reporting information collected from actors in is value chain. “Reasonable effort” entails that an undertaking should take into consideration the specific facts and circumstances of its value chain actors as well as the conditions of the external environment in which it operates. Hence, what constitutes reasonable effort will likely vary from undertaking to undertaking, depending on:

- size and resources;

- technical readiness, and

- the proximity of the actor in the value chain.

The Commission is concerned with the administrative burden for SMEs which are not in scope of CSRD themselves but are requested to provide sustainability data as actors in the value chain of a company that is subject to CSRD reporting obligations. In particular, smaller SMEs that have never been obliged to report or have never voluntarily reported sustainability information should be less exposed to expectations of collecting and sharing sustainability information than larger SMEs.

In addition, EFRAG is developing working on two sustainability reporting standards tailored for SMEs:

- a mandatory standard for listed SMEs (LSME ESRS); and

- a voluntary standard for non-listed SMEs (VSME).

The LSME ESRS will define the maximum level of sustainability information that an undertaking subject to the CSRD can require from SMEs within its value chain (see also our German post from 15 May 2024).

Conclusion

In conclusion, the FAQs present a helpful tool in clarifying CSRD and reducing the administrative burden on companies as they prepare for these new reporting requirements. By providing clarity and guidance, the European Commission aims to make the transition smoother and more cost-effective, ultimately ensuring that sustainability information is both usable and comparable across the EU.

For global companies with significant business presence in the EEA, it is high time to assess the scope of the CSRD application and familiarise themselves with the requirements and begin preparing for the upcoming ESG reporting obligations. The FAQ helps by offering the insights needed to navigate through the new regulatory landscape and to contribute to a more sustainable future. Whether you’re a large corporation, an SME, or an auditor, understanding these new requirements is key to staying compliant and contributing to the broader sustainability goals in the EU and far beyond its borders.