Singapore VCCs: Legal & Regulatory Essentials

Introduction

The Variable Capital Company (“VCC”) framework has emerged as a significant development in Singapore's fund management landscape, offering fund managers a flexible and efficient corporate structure for domiciling investment funds. The VCC corporate structure became available to the private funds industry following the enactment of the Variable Capital Companies Act 2018 (“VCC Act”), which took effect on 14 January 2020. The VCC Act is designed to enhance Singapore's position as a leading global fund domicile.

This article provides an overview of the key legal and regulatory considerations for establishing a VCC in Singapore, including the applicable regulatory framework, available structuring options, and the practical steps involved in setting up a VCC.

A. Overview of key regulations

The VCC regulatory framework in Singapore represents a comprehensive regulatory regime designed to position Singapore as a leading international fund management and domiciliation hub whilst maintaining robust regulatory oversight and investor protection.

Formation and Re-domiciliation

Fund managers may incorporate new VCCs or re-domicile their existing investment funds with comparable structures by transferring their registration to Singapore as VCCs. This can be done via ACRA's online application form. This flexibility facilitates the migration of established foreign corporate funds to Singapore whilst allowing a foreign investment fund to retain its corporate history and identity.

Primary and Subsidiary Legislation

The VCC Act and its subsidiary legislation serve as the principal legislation governing variable capital companies in Singapore. This Act provides for the incorporation, operation and regulation of VCCs in Singapore. The VCC Act applies many provisions of the Companies Act 1967 (“Companies Act”) subject to modifications aimed specifically at the needs of investment funds, creating a tailored regulatory regime specifically designed for investment funds whilst leveraging Singapore's established corporate law framework.

The Variable Capital Companies Regulations 2020 prescribe various forms, requirements and procedures for VCC operations, including requirements relating to the experience, professional and academic qualifications of VCC secretaries and factors for determining whether a person is fit and proper to act as a director of a VCC.

The VCC Act and its subsidiary legislation are administered by the Accounting and Corporate Regulatory Authority (“ACRA”).

AML/CFT obligations

VCCs are subject to stringent anti-money laundering and counter-financing of terrorism (collectively, “AML/CFT”) regulations and must engage an eligible financial institution to conduct necessary checks and implement measures to comply with the AML/CFT requirements under MAS Notice VCC-N01.

The anti-money laundering and countering the financing of terrorism obligations of VCCs come under the purview of the Monetary Authority of Singapore (“MAS”). The VCC Act empowers MAS to issue directions or make regulations concerning VCCs as MAS considers necessary for the prevention of money laundering or the financing of terrorism.

Fund Manager

A VCC must have a fund manager (“Permissible Fund Manager”) to manage its property or operate the collective investment schemes that comprise the VCC. The Permissible Fund Manager must be one that is regulated by MAS, such as a holder of a capital markets services licence for fund management under the Securities and Futures Act 2001 (“SFA”) or certain financial institutions exempted from the requirement to hold a capital markets services licence under the SFA.

A Permissible Fund Manager should segregate the VCC’s assets (e.g. equities, real estate or private equity) and maintain them with an independent custodian. The Permissible Fund Manager must also ensure any individual conducting fund management activity (e.g. providing inputs on the portfolio composition, marketing, etc.) for the VCC is appointed as a representative of the Permissible Fund Manager.

Governance and Compliance

Upon incorporation, VCCs must maintain a registered office and appoint at least 1 director who is ordinarily resident in Singapore, as more particularly described in Part (C) below.

In addition, a VCC must also comply with the following maintenance obligations:

appoint a Singapore resident company secretary (within 6 months of incorporation);

appoint a Singapore-based auditor (within 3 months of incorporation/registration);

maintain a register of auditors, directors, secretaries, and managers; and

maintain a register of members, which must be made available for inspection by (a) the VCC manager; (b) the custodian of the VCC (being a non‑umbrella VCC); (c) a public authority, or representative of a public authority, for the purpose of enabling the public authority to administer or enforce any written law; or (d) any person entitled to inspect the register of members pursuant to an order of the Court.

As with all Singapore companies, VCCs are required to prepare audited financial statements, and can choose to use either Singapore accounting standards or recognised international standards, such as the International Financial Reporting Standards (“IFRS”) or US Generally Accepted Accounting Principles (“US GAAP”) for the preparation of these financial statements.

B. VCC structures

Variable Capital Structure

The VCC has seen a notable increase in adoption in Singapore in recent years as it provides a flexible vehicle for fund management and mitigates the need to set up multiple separate legal entities. Singapore is already home to 1,029 umbrella or standalone VCCs as of the start of 2024.1

The VCC has a variable capital structure that provides flexibility in the issuance and redemption of its shares. It can also pay dividends out of capital rather than profits – this is a big plus point – as fund managers gain flexibility to meet dividend payment obligations. This distinguishes VCCs from traditional companies incorporated under the Companies Act, which face restrictions on capital reduction (only if the company is solvent) and dividend payments (only if the company is profitable).

Structuring a VCC

Depending on investment strategy, investor profile, and operational needs, a VCC can be structured in several ways.

Stand-alone VCC vs. Umbrella VCC

A VCC may be established as a single fund VCC (i.e. a stand-alone VCC) or a VCC with multiple sub-funds (i.e. an umbrella VCC).

Stand-alone VCC

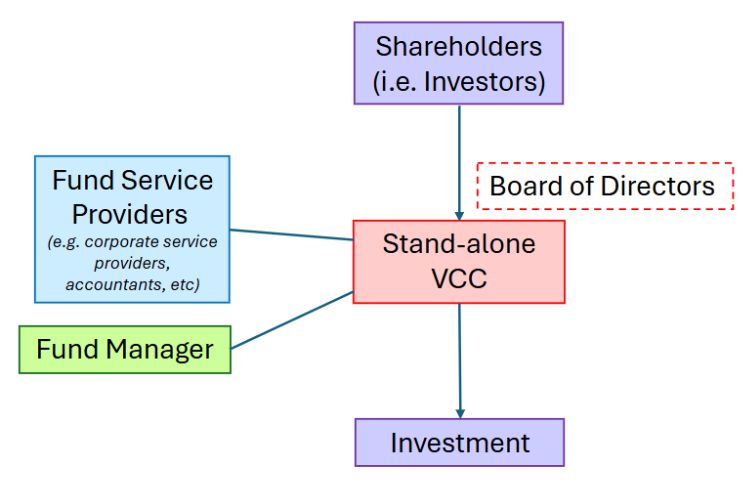

Figure 1: Example of a stand-alone VCC structure

A standalone VCC has only a single pool of assets and liabilities. This option is commonly used where the fund has:

A single investment strategy,

A uniform investor base, or

No immediate plans to launch additional strategies.

A standalone VCC offers simplicity in governance and compliance while retaining the core benefits of variable capital and access to Singapore’s fund tax incentive schemes (subject to eligibility).

Umbrella VCC

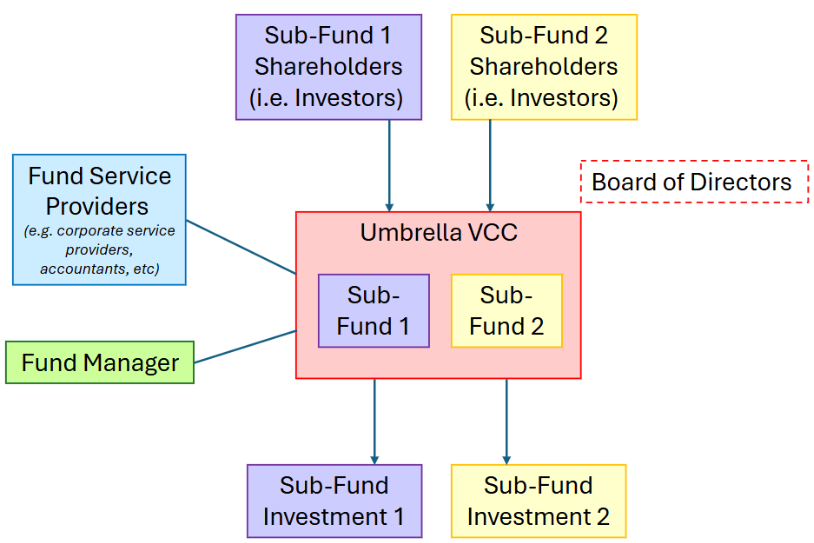

Figure 2: Example of an umbrella VCC structure

In contrast, an umbrella VCC allows for the creation of multiple sub-funds under a single legal entity. Each sub-fund can:

Pursue a different investment strategy,

Have different investors,

Hold distinct portfolios of assets.

Crucially, the assets and liabilities of each sub-fund must be kept segregated, such that the assets of one sub-fund may not be used to discharge the liabilities of another sub-fund. Under the law, any provisions that are inconsistent with such segregation of assets and liabilities of sub-funds would be void (section 29 of the VCC Act).

A sub-fund of a VCC is also permitted to invest in other sub-funds within the same VCC, subject to applicable regulatory and constitutional restrictions.

Although a sub-fund does not have separate legal personality, it is treated, for insolvency and enforcement purposes, as if it were a separate legal person. As such, a sub-fund is subject to court orders independently, and the VCC may sue or be sued in respect of a particular sub-fund. The VCC may also exercise rights of set-off in relation to that sub-fund in the same manner as a company incorporated under the Singapore Companies Act.

This structure is particularly attractive to fund managers seeking to launch multiple strategies (such as ESG, PE, Hedge Fund or VC) effectively under a single corporate vehicle whilst benefiting from the synergies of operational efficiency, shared resources, and streamlined compliance.

Open-Ended vs Closed-Ended Structures

A VCC (whether stand-alone or umbrella) can be structured as:

an open-ended fund, allowing investors to subscribe for and redeem their investments at their discretion; or

a closed-ended fund, which align with more traditional fund strategies, that does not allow investors to freely redeem their investments, and also does not allow new subscriptions after the offering period is over.

MAS has also clarified that an umbrella VCC may consist of both open-ended and close-ended funds, providing greater flexibility for structuring the VCC. The choice depends on liquidity needs, asset class, and investor expectations.

C. How to set up a VCC

To set up a VCC, the following steps must be completed:

Select a Manager

As above, every VCC must appoint a Permissible Fund Manager to manage its property or to operate the collective investment scheme or schemes that comprise the VCC. The manager is responsible for the overall investment management, compliance, and operational oversight of the VCC.

Where a proposed manager does not yet hold the requisite licence or registration, an application to MAS will be required. The licensing process typically takes approximately 6 months and should be factored into the overall timeline for establishing the VCC.

Select Director(s)

Every VCC must have at least 1 director who is ordinarily resident in Singapore (e.g. Singapore citizens, Permanent residents or holders of EntrePass/ Employment Pass) with a local residential address.

In addition, every VCC must also have at least 1 director (who may be the same person that is ordinarily resident in Singapore) who is either:

a Qualified Representative (as defined under the VCC Act); or

a director of its fund manager.

Where the VCC operates Authorised Schemes, at least three directors must be appointed, including at least one independent director. An Authorised Scheme refers to a collective investment scheme constituted in Singapore and authorised by MAS.

Select a name and proceed with name reservation

Once a suitable name has been identified, a name reservation application must be submitted to the ACRA. Name applications are generally processed within 1 working day.

However, if the proposed name requires approval from another regulatory or licensing authority, ACRA will grant approval only after such approval has been obtained. In such cases, the processing time may be extended by up to 14 working days.

Upon approval, the name is reserved for a period of 120 days. The VCC must be incorporated within this reservation period, failing which a fresh name reservation application will be required.

Select the VCC type

A VCC can be established as either (i) an umbrella fund VCC or (ii) a stand-alone VCC, as described more particularly in Part (B) above.

Select a registered office address / Engage a company secretary

A VCC must have a registered office address in Singapore, which must be provided to ACRA at the time of incorporation. The registered office must be a physical address and not a post office box.

Where the promoters of the VCC do not have access to a suitable local address, a corporate secretarial service provider may be engaged to provide a registered office address and company secretarial services. In any event, a VCC is also required to appoint a company secretary who is resident in Singapore, within 6 months of incorporation.

Subscriber details

Details of the subscriber(s) to the VCC must be identified at the outset. At least one subscriber is required to agree to take up shares in the VCC upon incorporation. The subscriber may be an individual or a corporate entity, and relevant identification and due diligence information will typically be required as part of the incorporation process.

Constitution

The constitution is the primary governing document of a VCC and sets out its structure, objectives, and rules of operation. It regulates the relationship between the VCC and its members, as well as among the members themselves.

Key matters addressed in the constitution include:

Name of the VCC

the name of the appointed manager;

the full name, address, and occupation of each subscriber;

the number of shares agreed to be taken by each subscriber; and

the rights attaching to shares, including voting, distribution, and participation rights.

The constitution must be prepared in advance and submitted as part of the application to incorporate the VCC.

Other Documents

Depending on the structure and nature of the VCC, additional documents may be required, including:

board and shareholder resolutions;

VCC offering documents (e.g. fund management agreement);

subscription or capital commitment agreement;

fund administration agreements; and

fund administration and custody agreements.

These documents support the operational and regulatory framework of the VCC and are typically finalised alongside the incorporation process.

D. Conclusion

The VCC framework represents a compelling option for fund managers seeking to establish or re-domicile investment funds in Singapore. With its flexible capital structure, ability to accommodate both open-ended and closed-ended strategies, and the option to operate as a stand-alone or umbrella structure, the VCC offers significant versatility to meet diverse fund management needs.

Fund managers considering the establishment of a VCC should engage experienced legal and regulatory advisors early in the process to ensure compliance with the applicable requirements under the VCC Act and other local regulations. Proper structuring and governance from the outset will position the VCC for operational efficiency and long-term success within Singapore's regulatory environment.

This article is produced by our Singapore office, Bird & Bird ATMD LLP. It does not constitute legal advice and is intended to provide general information only. Information in this article is accurate as of 17 January 2026.